Mortgage calculator with large principal payment

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. Most people need a mortgage to finance a home purchase.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

. But if you have large funds you can use it to decrease a considerable portion of your loan. A portion of the monthly payment is called the principal which is the original amount borrowed. The piggyback second mortgage can also be financed through an 8020 loan structure.

This calculator will calculate the weekly payment and associated interest costs for a new mortgage. However as the outstanding principal declines interest costs will subsequently fall. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Note that the monthly payment shown includes only principal and interest. These loans have a single large lump sum due at maturity. 30-Year Fixed Mortgage Principal Loan Amount.

In a year you might receive lump sum payments in the form of. Some loans such as balloon loans can also have smaller routine payments during their lifetimes but this calculation only. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance.

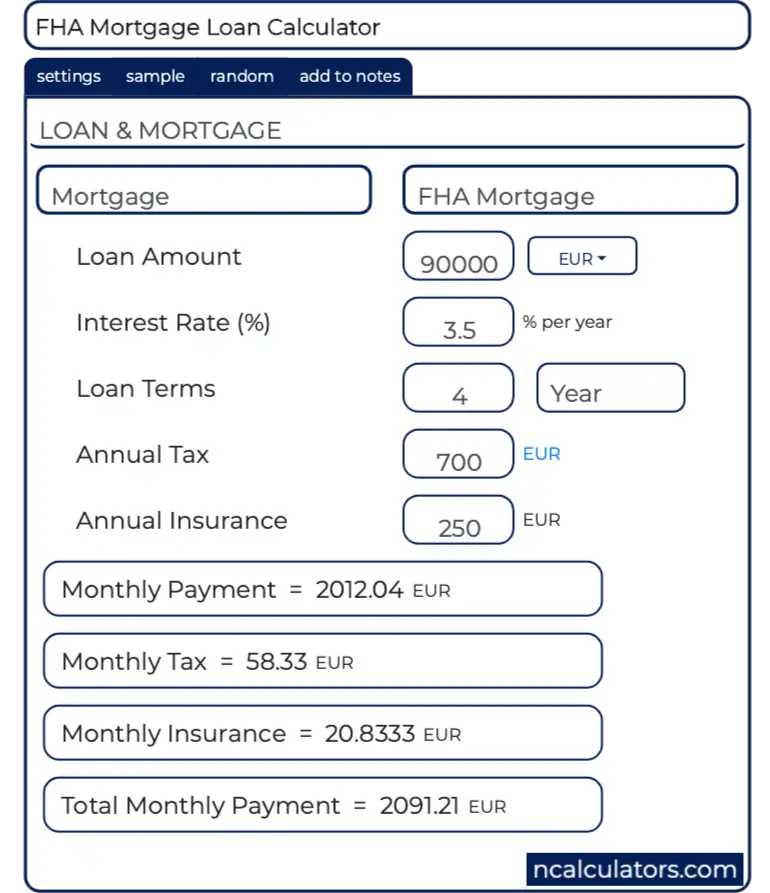

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. PITI is an acronym that stands for principal interest taxes and insuranceAfter inputting the cost of your annual property.

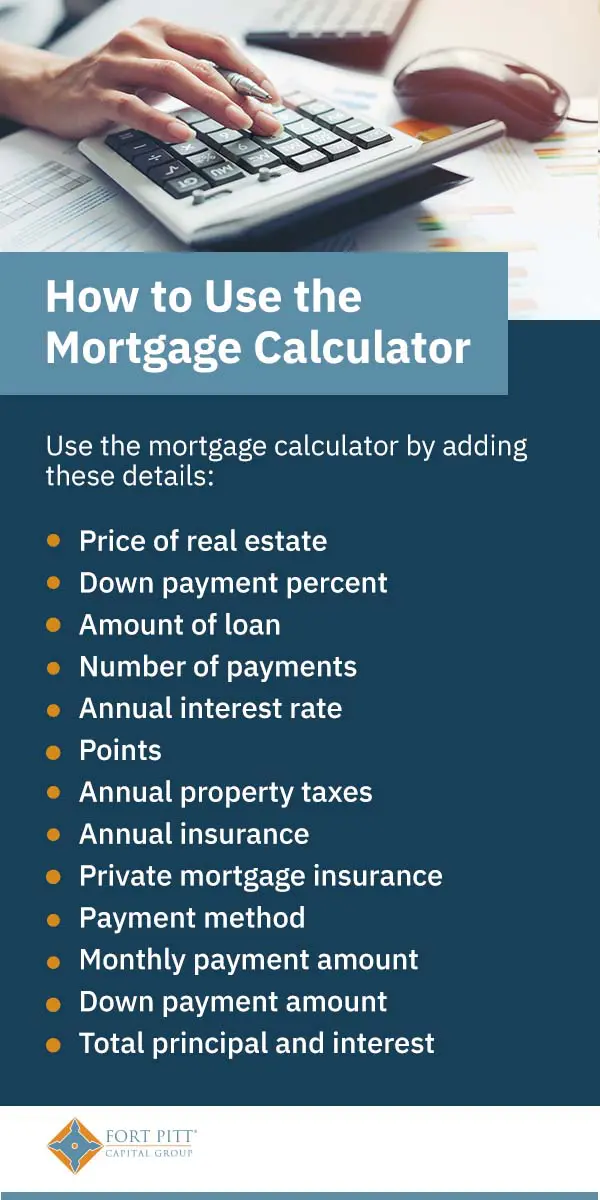

Four alternatives to paying extra mortgage principal. Mortgage loan payment calculator. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals. With a few inputs you can determine how much mortgage you may be comfortable with and the potential price range of your future home. A mortgage payment typically consists of four components often referred to as PITI.

To the extent the new debt is more than that mortgage principal it is treated as home acquisition debt so long as the proceeds were used to buy build or substantially improve the home and the mortgage is a mixed-use mortgage discussed later under Average Mortgage Balance in the Table 1 Instructions. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per. Make Lump Sum Loan Payments.

Consider how long you plan on living in the home. Each month a payment is made from buyer to lender. Mortgage calculator - calculate payments see amortization and compare loans.

Usually 15 or 30 years in the US. You can also see the savings from prepaying your mortgage using 3 different methods. The loan is secured on the borrowers property through a process.

You can make extra payments regularly or a lump-sum payment toward the mortgage principal to reach that 20 sooner. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan.

You can also use the calculator on top to estimate extra payments you make once a year. First Payment Due - due date for the first payment. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

In the example above after one year of additional payments the principal amount would increase to 13700. If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and. Principal interest taxes and insurance.

The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. Use Moneys free mortgage calculator to get an estimated monthly mortgage payment based on your loan details. PrincipalThis is the total amount of money you borrow from a lender.

In contrast to the previous. Once the user inputs the required. Which can be added to the principal amount of your mortgage.

The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. You can also try reducing PMI by reappraising or remodeling your home. However as the loan progresses the ratio of interest and principal inverts so that eventually the principal represents the majority of the payment.

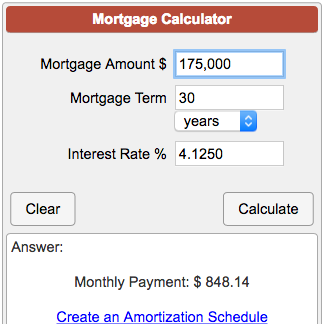

Also shorter-term mortgages offer a lower interest rate which allows for a larger amount of principal repaid with each mortgage payment. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the.

Found on the Set Dates or XPmts tab. Todays national mortgage rate trends. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. A borrower continues to match the principal amount with an additional payment. Thus shorter term mortgages cost significantly less overall.

The debt must be secured by the. One such tool is our multifamily mortgage calculator which can estimate the monthly payments owed on a multifamily mortgage. Thus with each successive payment the portion allocated to interest falls while the amount of principal paid rises.

Recurring extra payments add up to reduce your principal balance. To estimate how much time and interest you can save use our extra mortgage payment calculator. The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely.

Which plays a large role in whether. The first step in searching for your home is understanding how large of a mortgage you can afford. Early on in the loans term a relatively large share of the payment is applied toward interest then as the borrower pays down the loan an increasing share of the payment goes toward interest.

All you have to do is input the loan amount and interest rate then set the amortization and term length to see the monthly payment figure over time. Mortgage Closing Date - also called the loan origination date or start date. Use this PITI calculator to calculate your estimated mortgage payment.

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Mortgage Calculator With Down Payment Dates And Points

Biweekly Mortgage Calculator

Mortgage Calculator Money

Mortgage With Extra Payments Calculator

Calculator For Mortgage Online 51 Off Www Wtashows Com

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Extra Payment Mortgage Calculator For Excel

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

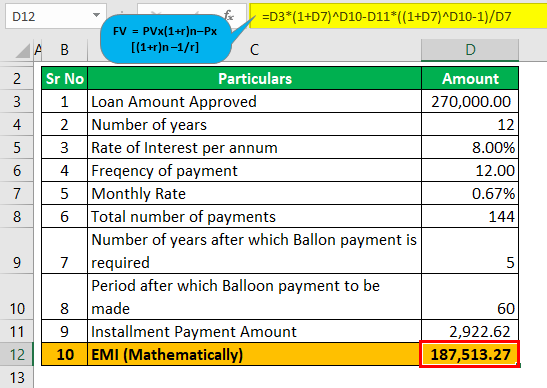

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Mortgage Calculator Estimate Your Monthly Payments

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

Repayment Mortgage Calculator Clearance 55 Off Www Wtashows Com

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Fha Mortgage Calculator